New U.S. SEC climate-related disclosures rules

Rules will require SEC filings such as annual reports include climate risk disclosures.

The U.S. Securities and Exchange Commission (SEC) has approved new rules as of March 6, 2024 to improve and standardize climate-related disclosures for public companies and public offerings. These rules require that companies include climate risk disclosures in their SEC filings, such as annual reports and registration statements, rather than solely on their websites, to ensure greater reliability. These new rules are a watershed for U.S. companies which now must make climate-related disclosures on par with their financial disclosures.

The finalized rules will require companies to disclose (*):

- Climate-related risks that will likely have material impacts on business strategy, financials, or operations, as well as actual and potential impacts.

- Both quantitative and qualitative summaries of financial impacts and expenditures related to climate change mitigation or adaptation efforts, if such actions have been taken.

- Actions to address climate-related risks, including transition plans, scenario analysis, and internal carbon pricing.

- Board oversight and management’s role in assessing climate-related risks.

- Processes for managing material climate-related risks.

- Information on climate-related targets or goals and their impact on the business, operations, and financial condition, including expenditures, impacts on financial estimates, and actions taken to achieve the targets.

- Details on Scope 1 and/or Scope 2 emissions for large, accelerated filers and accelerated filers.

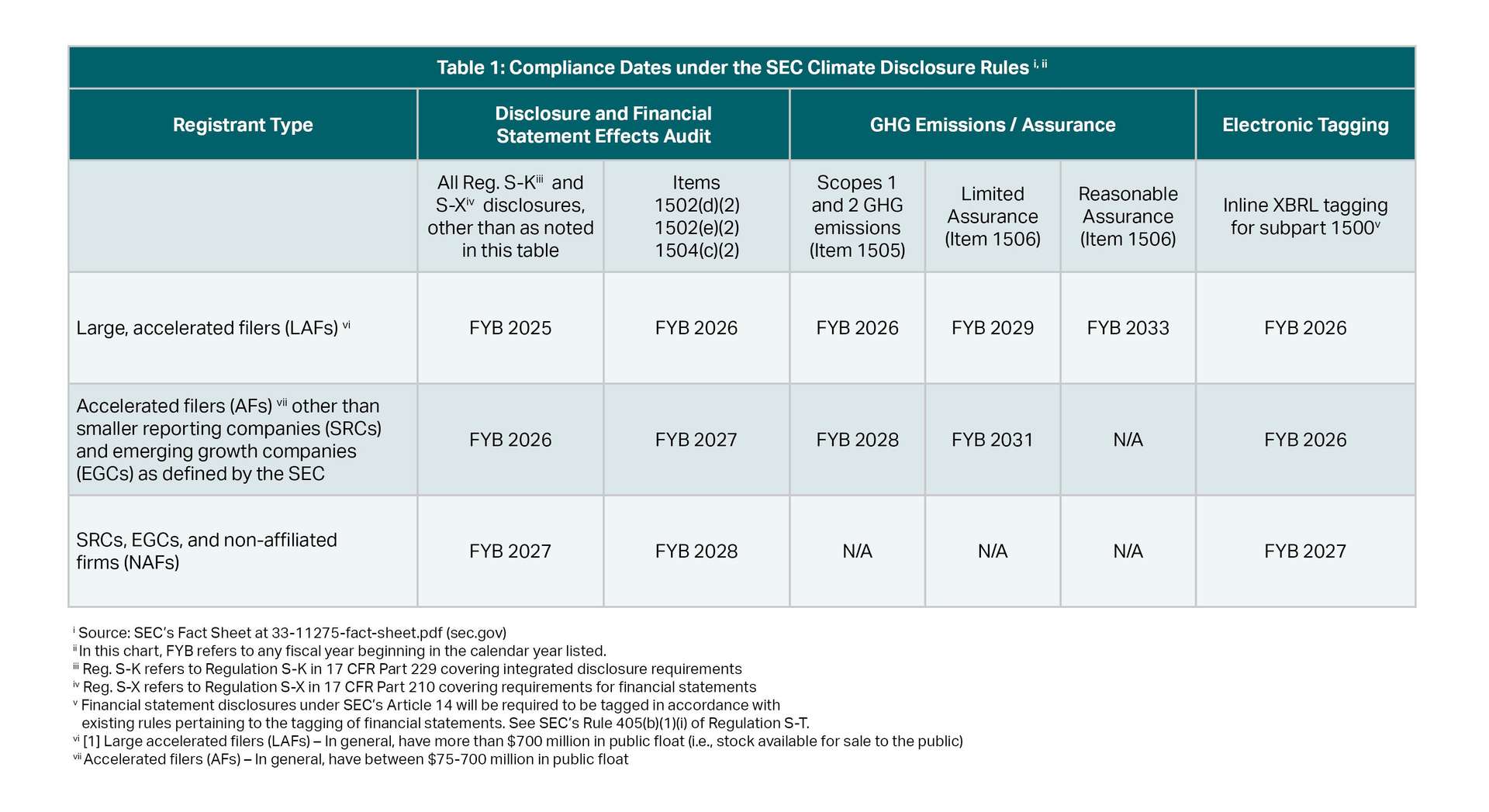

- For large, accelerated filers, an assurance report on GHG emissions at the limited assurance level for fiscal years (FYs) beginning in 2029 and reasonable assurance for FYs beginning in 2033 (see table below)

- Costs, expenditures, and losses related to severe weather events and natural conditions, disclosed in the financial statements.

- Expenses and losses related to carbon offsets and renewable energy credits if they are a significant part of the company's efforts to meet climate-related targets.

- Impact of risks and uncertainties related to weather events, natural conditions, climate-related targets, or transition plans on the financial estimates and assumptions used by the company.

Mandatory reporting of Scope 3 emissions has been excluded from this final rule, which is a significant easing from the draft rule.

The SEC is staying current with global trends, such as the recent California ( ** ) and European ( *** ) climate reporting laws, which are being phased in over the next few years and will also require outside review of GHG data.

The final rule becomes effective 60 days after being published in the Federal Register. Legal challenges to these requirements are expected. Compliance will be phased per Table 1 below.

How AECOM can help

AECOM’s ESG, Sustainability, and Carbon and Climate Advisory Teams support organizations in developing enhanced climate-related reporting and risk management while also delivering technical sustainability solutions such as decarbonization and clean energy development. We actively work with organizations in bridging their strategies for managing physical and transition climate-related risks with the technical, scientific underpinnings that are needed to produce transformative change and develop enterprise-wide sustainability solutions. Specifically, AECOM not only advises on climate-related matters but we can design, build, and commission sustainable solutions. We help clients identify and mitigate climate and sustainability risks, develop and implement long-term sustainability plans, prepare disclosures for third-party assurance, meet and exceed reporting regulations and standards, and deliver ESG digital transformations to support the drive towards financial-quality data. Learn more at Sustainable-Legacies.com.

Contacts:

Robert Spencer, Global Head of ESG Advisory Services

Ana Ossers, M.Sc., ENV SP, ESG Corporate Advisory - Americas

Jim Haried, MBA, ENV SP, Senior ESG Advisor, United States

Elizabeth Logan, ESG Practice Lead - Canada

Footnotes

(*) Final rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors AGENCY: Securities and Exchange Commission & SEC.gov | SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors

(**) California’s SB 253 requires disclosures of scopes 1/2/3 emissions for companies with large presence in California. California’s SB 261 requires disclosures of climate-related risks for companies with large presence in California.

(***) European climate reporting rules include the Corporate Sustainability Reporting Directive (CSRD issued in April 2021), IFRS standards S1 and S2 (issued June 2023) requiring disclosure of sustainability-related risks and opportunities, and the European Sustainability Reporting Standards (ESRS released in July 2023).